Government decreases Petrol and Diesel prices Rs 6.17 — Rs 10.86 per liter

KARACHI: The Finance Division has decreased the prices of Petroleum products for the next fortnight starting from first August 2024.

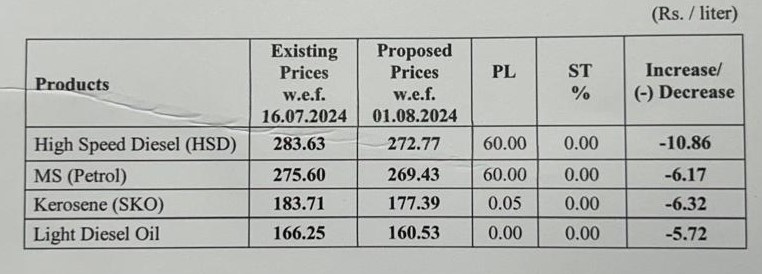

The prices of petroleum products — petrol and high-speed diesel (HSD) — decreased up to Rs 6.17 and Rs 10.86 per litre, respectively, with effect from August 1, 2024. The government has decreased the petroleum products prices in all over the country mainly because of low global oil prices.

The government has set new petrol price from 275.60 to Rs 269.43, high speed diesel (HSD) prices from Rs 283.63 to Rs 272.72, Kerosene (SKO) from Rs 181.71 to Rs 177.39, and Light Diesel Oil from Rs 166.24 to Rs 160.53.

Sources said the prices of petrol and HSD had decreased in the international market by about $4.4 and $2 per barrel, respectively, in the last fortnight. Depending on final calculation and existing tax rates, the price of petrol is projected to decrease by Rs 6.17 per litre and that of HSD by Rs 10 per litre.

The government, in the last budget, has jacked up the maximum limit of petroleum development levy (PDL) to Rs 70 per litre in the Finance Bill to collect Rs 1.28 trillion in the current fiscal year against Rs 960 billion collection during the previous year, almost Rs 91 billion higher than the Rs 869 billion budget target.

On the other hand, last fortnight, the rupee was stable against the US dollar in interbank market with minor change.

The ex-depot prices for petrol and HSD, thus, stand at Rs 275.60 and Rs 283.63 per litre, respectively.

Between May 1 and June 15, petrol and high-speed diesel prices were reduced by about Rs 35 per litre and Rs 22 per litre, respectively.

The government currently charges about Rs 77 per litre tax on both petrol and HSD. Although the general sales tax (GST) is zero on all petroleum products, the government charges Rs 60 per litre PDL on both products, which normally impacts the masses. The government is also charging about Rs 17 customs duty on a litre of petrol and HSD, irrespective of their local production or imports.

Petroleum and electricity prices have been the key drivers of high inflation. Petrol is mostly used in private transport, small vehicles, rickshaws and two-wheelers.

On the other hand, an increase in diesel’s price is considered highly inflationary as it is mostly used in heavy transport vehicles and particularly adds to the prices of vegetables and other eatables.