IBM announced to acquire Red Hat in a deal valued at about $34bn.

LAS VEGAS: IBM is acquiring Red Hat, a major distributor of open-source software and technology, in a deal valued around $34 billion, the companies announced on Sunday night.

According to a joint statement, IBM will pay cash to buy all shares in Red Hat at $190 each. Shares in Red Hat closed at $116.68 on Friday before the deal was announced.

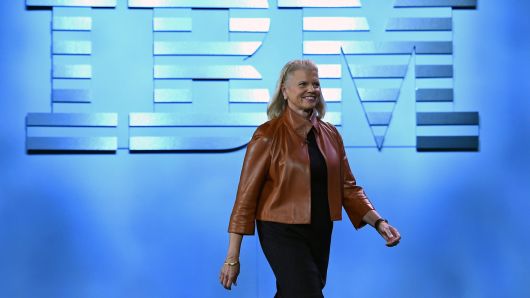

The open source, enterprise software maker will become a unit of IBM’s Hybrid Cloud division, with Red Hat CEO Jim Whitehurst joining IBM’s senior management team and reporting to CEO Ginni Rometty.

Goldman Sachs, J.P. Morgan and Lazard advised IBM on the Red Hat deal. Morgan Stanley and Guggenheim advised Red Hat.

The acquisition is by far IBM’s largest deal ever, and the third-biggest in the history of U.S. tech. Excluding the AOL-Time Warner merger, the only larger deals were the $67 billion merger between Dell and EMC in 2016 and JDS Uniphase’s $41 billion acquisition of optical-component supplier SDL in 2000, just as the dot-com bubble was bursting.

Red Hat started 25 years ago as a distributor of a particular flavor of Linux, an open-source operating system that is commonly used in server computers that power company data centers. Today, Red Hat is known for distributing and supporting Red Hat Enterprise Linux, as well as other technologies commonly used in data centers. The company, which went public at the peak of the dot-com boom in 1999, earned $259 million on revenue of $2.92 billion in its last fiscal year, which ended Feb. 28. Its revenue grew 21% between the 2017 and 2018 fiscal years.