UBL to conduct due diligence of TMB

2 min read

The SBP has granted in-principle approval of UBL to commence the Due-diligence of Telenor Microfinance Bank for the proposed acquisition of 55% sponsor shares in TMB

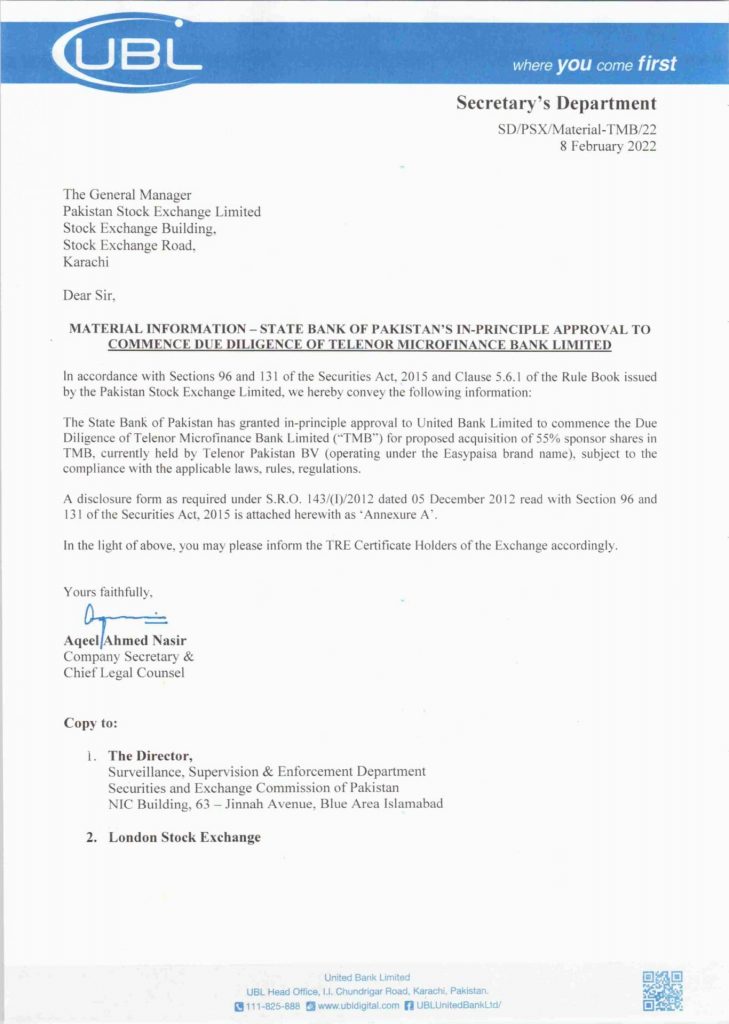

KARACHI: The State Bank of Pakistan (SBP) has given approval to United Bank Limited (UBL) for conducting due diligence of Telenor Microfinance Bank (TMB) in Pakistan.

Norway’s Telecom Giant ‘Telenor Pakistan’ had said that the company was considering a potential sale of its 55 percent ownership stake in Telenor Microfinance Bank in Pakistan and that a process to evaluate interested partners has been initiated.

“The State Bank of Pakistan has granted in-principle approval of United Bank Limited to commence the Due-diligence of Telenor Microfinance Bank Limited (TMB) for the proposed acquisition of 55 percent sponsor shares in TMB, currently held by Telenor Pakistan BV (operating under the Easypaisa brand name), subject to the compliance with the applicable law, rules, regulations,” the UBL said in a notice sent to the Pakistan Stock Exchange here on Tuesday.

Earlier, in November 2021, the SBP had also given approval to MCB bank for the due diligence of the TMB, but the final decision to acquire the microfinance bank is still pending.

The MCB has also started the due diligence process and would take some time to come up with an offer.

A statement posted by the Telenor Group on its website two months ago said the company was considering a potential sale of its 55 percent ownership stake in Telenor Microfinance Bank in Pakistan, and that a process to evaluate interested partners has been initiated.

Telenor Group is continuously reviewing strategic and structural options to ensure long-term value creation for its shareholders. TMB has been driving digital innovation in the financial sector for more than 10 years and has firmly established its position as a leading Fintech company in Pakistan. A process to evaluate partners committed to support TMB’s long-term growth strategy has been initiated.

TMB has been innovating to offer inclusive digital financial services to its customers and its growth speaks of its success. As a shareholder of Telenor Microfinance Bank, and together with Telenor Group, we will continue to support the bank during this process as it brings innovative solutions to the market.

Telenor Microfinance Bank would continue its operation as normal with Telenor Pakistan as a committed partner.

TMB is jointly owned by Telenor Group and Ant Group. The bank was established in 2005 and has successfully developed into a significant player in Pakistan’s financial landscape, providing both traditional banking solutions and digital financial services. In 2009, the bank launched Pakistan’s first mobile banking platform Easypaisa, transforming digital payments in the country.